Debt can be a heavy burden to bear, weighing us down with constant stress and worry. But fear not, because there is a solution to help you conquer your debts and achieve financial freedom. It’s called the Debt Snowball Method, and with the help of some handy printables, you’ll be well on your way to paying down your debt and taking control of your finances.

Debt Snowball Tracker Printable - Simply Unscripted

Take a look at this free printable from Simply Unscripted. It’s a Debt Snowball Tracker that allows you to visually see your progress as you pay off your debts. By focusing on one debt at a time and putting extra money towards it while making minimum payments on the others, you’ll be able to quickly see your debts disappear.

Take a look at this free printable from Simply Unscripted. It’s a Debt Snowball Tracker that allows you to visually see your progress as you pay off your debts. By focusing on one debt at a time and putting extra money towards it while making minimum payments on the others, you’ll be able to quickly see your debts disappear.

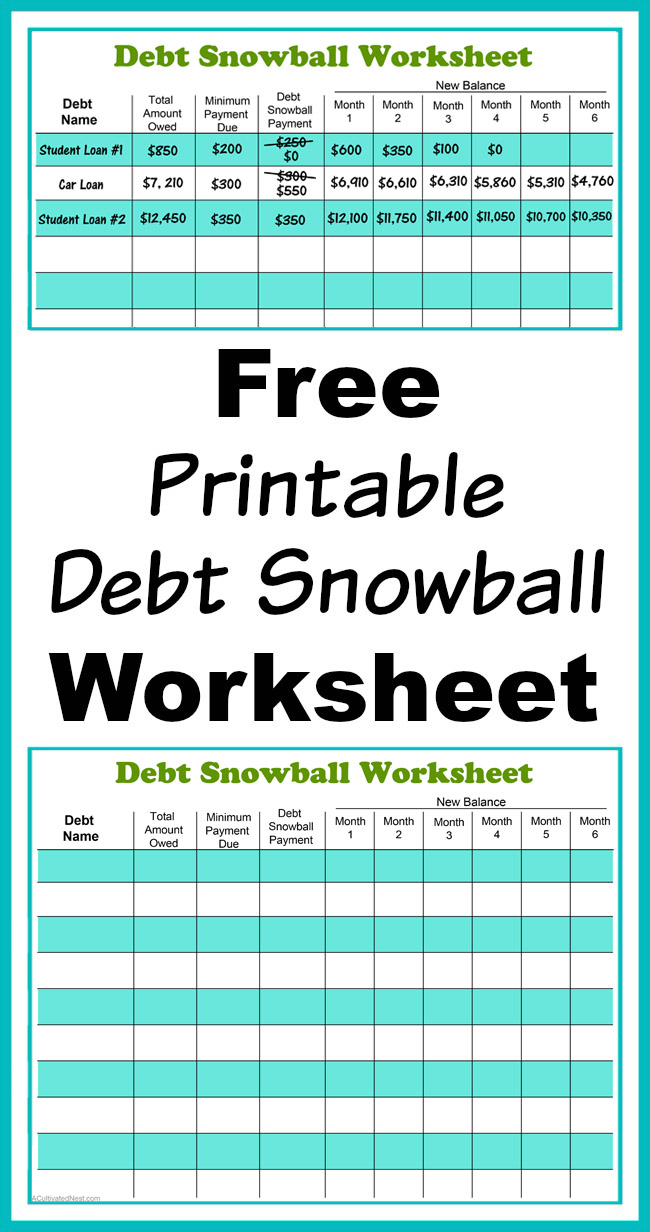

Free Printable Debt Snowball Worksheet- Pay Down Your Debt! - A Cultivated Nest

A Cultivated Nest offers a free printable Debt Snowball Worksheet that provides a clear and organized way to track your debts. It includes sections to write down your debts, their balances, and your monthly payment amounts. As you make progress, you’ll be able to cross off each debt and see how close you are to becoming debt-free.

A Cultivated Nest offers a free printable Debt Snowball Worksheet that provides a clear and organized way to track your debts. It includes sections to write down your debts, their balances, and your monthly payment amounts. As you make progress, you’ll be able to cross off each debt and see how close you are to becoming debt-free.

130+ Free Printables to Help You Get Organized This year! - Dishes

If you’re looking for more than just a Debt Snowball Tracker, Dishes has got you covered. They offer a variety of free printables to help you get organized, including a Debt Snowball Worksheet. This printable includes extra features like a due date column and a notes section, allowing you to stay on top of your debt repayment journey.

If you’re looking for more than just a Debt Snowball Tracker, Dishes has got you covered. They offer a variety of free printables to help you get organized, including a Debt Snowball Worksheet. This printable includes extra features like a due date column and a notes section, allowing you to stay on top of your debt repayment journey.

38 Debt Snowball Spreadsheets, Forms & Calculators - TemplateLab

If you prefer digital tools, TemplateLab has a collection of 38 Debt Snowball spreadsheets, forms, and calculators available for download. These templates are customizable and allow you to input your specific debt information, making it easier to track your progress and create a repayment plan that suits your needs.

If you prefer digital tools, TemplateLab has a collection of 38 Debt Snowball spreadsheets, forms, and calculators available for download. These templates are customizable and allow you to input your specific debt information, making it easier to track your progress and create a repayment plan that suits your needs.

Debt Snowball Tracker Printable Debt Free Chart Debt Payoff - Etsy Canada

If you’re looking for a more visually appealing printable, Etsy Canada has a Debt Snowball Tracker that doubles as a beautiful chart. It allows you to color in each step as you pay off your debts, creating a sense of accomplishment and motivation to keep going.

If you’re looking for a more visually appealing printable, Etsy Canada has a Debt Snowball Tracker that doubles as a beautiful chart. It allows you to color in each step as you pay off your debts, creating a sense of accomplishment and motivation to keep going.

5 Debt Snowball Excel Templates - Excel xlts

For those who prefer using Excel, Excel xlts offers 5 Debt Snowball templates that can be easily customized to fit your needs. These templates allow you to input your debt details, interest rates, and minimum payments, and automatically calculate how long it will take to pay off your debts.

For those who prefer using Excel, Excel xlts offers 5 Debt Snowball templates that can be easily customized to fit your needs. These templates allow you to input your debt details, interest rates, and minimum payments, and automatically calculate how long it will take to pay off your debts.

Free Debt Snowball Method Worksheet - Simply Unscripted

Simply Unscripted provides another free Debt Snowball worksheet, this time focusing on the Debt Snowball Method. This method involves listing your debts in order from the smallest balance to the largest and paying them off in that order. The worksheet helps you track your progress and stay motivated as you eliminate each debt one by one.

Simply Unscripted provides another free Debt Snowball worksheet, this time focusing on the Debt Snowball Method. This method involves listing your debts in order from the smallest balance to the largest and paying them off in that order. The worksheet helps you track your progress and stay motivated as you eliminate each debt one by one.

Free Debt Snowball Printable Worksheets – Simplistically Living

![]() Simplistically Living offers a set of Debt Snowball Printable Worksheets that cover all aspects of debt repayment. They include a Debt Snowball Worksheet, a Debt Payment Tracker, and a Monthly Budget Worksheet. These printables work together to help you stay organized and on track to becoming debt-free.

Simplistically Living offers a set of Debt Snowball Printable Worksheets that cover all aspects of debt repayment. They include a Debt Snowball Worksheet, a Debt Payment Tracker, and a Monthly Budget Worksheet. These printables work together to help you stay organized and on track to becoming debt-free.

Debt Snowball Printable Sheet: Dave Ramsey Inspired Debt - Etsy

If you’re a fan of Dave Ramsey and his debt reduction strategies, you’ll love this Debt Snowball Printable Sheet from Etsy. Inspired by Dave Ramsey’s teachings, this printable allows you to track your debts and visually see your progress as you work towards becoming debt-free.

If you’re a fan of Dave Ramsey and his debt reduction strategies, you’ll love this Debt Snowball Printable Sheet from Etsy. Inspired by Dave Ramsey’s teachings, this printable allows you to track your debts and visually see your progress as you work towards becoming debt-free.

By using these Debt Snowball printables, you’ll have the tools you need to take control of your debt and work towards financial freedom. Whether you prefer a tracker, spreadsheet, or visual chart, there’s a printable out there that suits your style and helps you stay motivated on your debt repayment journey. So start today, tackle your debts one by one, and before you know it, you’ll be celebrating your debt-free future!