Instructions for Forms 1099-MISC and 1099-NEC (2021)

Instructions for Forms 1099-MISC and 1099-NEC (2021)

When it comes to filing taxes, there are various forms that individuals and businesses need to be aware of. Two such forms are the 1099-MISC and 1099-NEC. These forms are used to report income that is not considered wages, salaries, or tips. Whether you are a freelancer, independent contractor, or a business paying vendors and contractors, it is important to understand the instructions for these forms to ensure accurate reporting.

When it comes to filing taxes, there are various forms that individuals and businesses need to be aware of. Two such forms are the 1099-MISC and 1099-NEC. These forms are used to report income that is not considered wages, salaries, or tips. Whether you are a freelancer, independent contractor, or a business paying vendors and contractors, it is important to understand the instructions for these forms to ensure accurate reporting.

The Internal Revenue Service (IRS) provides detailed instructions for Forms 1099-MISC and 1099-NEC for the year 2021. These instructions outline the requirements and provide guidance on how to fill out these forms correctly. It is crucial to review these instructions and follow them diligently to avoid any errors or potential audits.

Form 1099-MISC is used to report income received by individuals who are not employees but receive income for services provided, rent, prizes, royalties, and other types of income. On the other hand, Form 1099-NEC is specifically used to report non-employee compensation. This form was reintroduced in 2020 after being separated from the 1099-MISC form.

Form 1099 Definition

:max_bytes(150000):strip_icc()/1099r-eda9fdcb4d82449da27f9f30a318aaa3.jpg) The term “1099” refers to a series of forms used to report various types of income apart from salaries and wages. These forms help the IRS keep track of income that is not subject to typical withholding taxes. Additionally, they ensure that individuals and businesses accurately report their income and pay the necessary taxes.

The term “1099” refers to a series of forms used to report various types of income apart from salaries and wages. These forms help the IRS keep track of income that is not subject to typical withholding taxes. Additionally, they ensure that individuals and businesses accurately report their income and pay the necessary taxes.

Printable 1099 Div Form 2021

Printable 1099 Div Form 2021

If you prefer to fill out your forms manually, a printable version of the 1099 Div Form for the year 2021 is available. This form is used to report dividends and distributions received during the tax year. It is essential to accurately report this income to avoid any penalties or legal complications.

If you prefer to fill out your forms manually, a printable version of the 1099 Div Form for the year 2021 is available. This form is used to report dividends and distributions received during the tax year. It is essential to accurately report this income to avoid any penalties or legal complications.

Free Printable 1099 Tax Form

Free Printable 1099 Tax Form

For individuals or businesses looking for a free printable version of the 1099 Tax Form, it can be found online. This form is used to report various types of income, including self-employment income, interest income, and rent income. It is essential to accurately report this income to fulfill your tax obligations.

For individuals or businesses looking for a free printable version of the 1099 Tax Form, it can be found online. This form is used to report various types of income, including self-employment income, interest income, and rent income. It is essential to accurately report this income to fulfill your tax obligations.

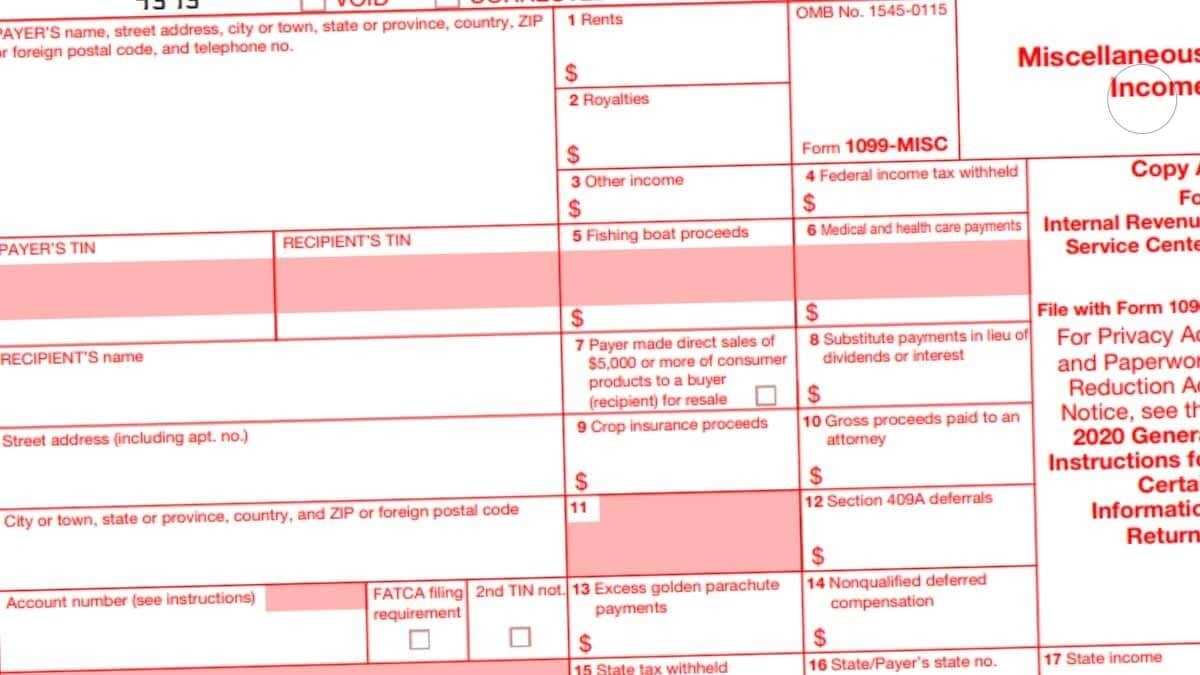

Form 1099-MISC: Miscellaneous Income Definition

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) When it comes to reporting income that does not fit into standard categories, the Form 1099-MISC is used. This form is specifically designed to report miscellaneous income received by individuals or businesses. Some examples of income reported on this form include rent, royalties, prizes, and awards.

When it comes to reporting income that does not fit into standard categories, the Form 1099-MISC is used. This form is specifically designed to report miscellaneous income received by individuals or businesses. Some examples of income reported on this form include rent, royalties, prizes, and awards.

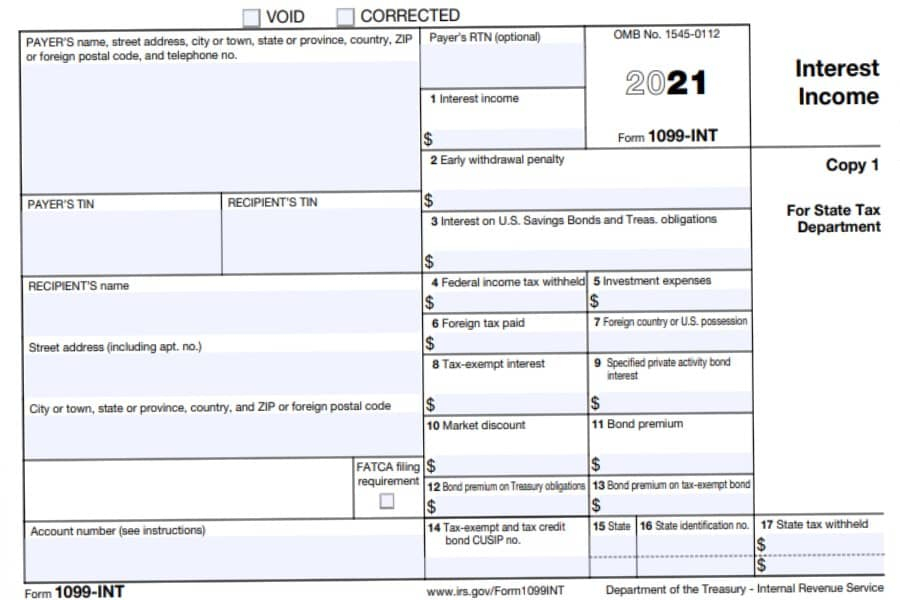

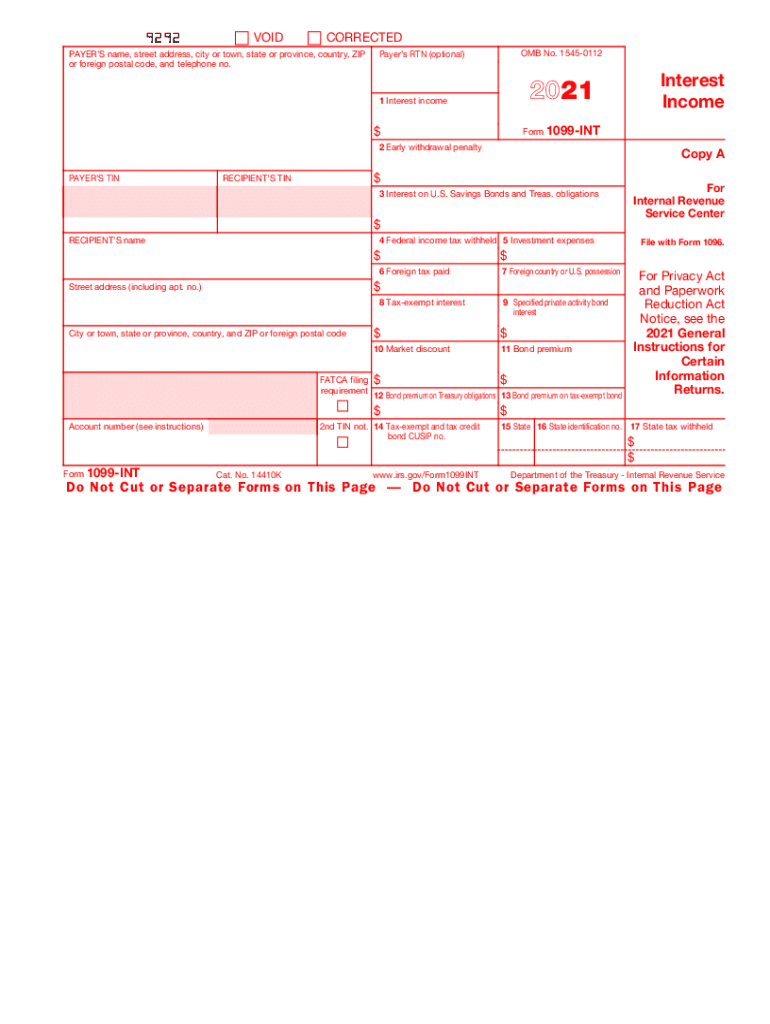

2021 Form IRS 1099-INT

2021 Form IRS 1099-INT

If you have earned interest income during the tax year, you may need to fill out the 2021 Form IRS 1099-INT. This form is specifically used to report interest income received from banks, financial institutions, or credit unions. It is important to accurately report this income to ensure compliance with tax regulations.

If you have earned interest income during the tax year, you may need to fill out the 2021 Form IRS 1099-INT. This form is specifically used to report interest income received from banks, financial institutions, or credit unions. It is important to accurately report this income to ensure compliance with tax regulations.

TSP 2020 Form 1099-R Statements Should Be Examined Carefully

For individuals who have a Thrift Savings Plan (TSP) account, it is essential to carefully examine the Form 1099-R statements for the year 2020. These statements detail distributions or withdrawals made from the TSP account and the associated taxes. It is crucial to review these statements thoroughly to ensure accuracy and avoid any tax implications.

For individuals who have a Thrift Savings Plan (TSP) account, it is essential to carefully examine the Form 1099-R statements for the year 2020. These statements detail distributions or withdrawals made from the TSP account and the associated taxes. It is crucial to review these statements thoroughly to ensure accuracy and avoid any tax implications.

[最も好ましい] 1099 c form 2020 166315-2020 form 1099-c cancellation of debt

[最も好ましい] 1099 c form 2020 166315-2020 form 1099-c cancellation of debt

Individuals or businesses dealing with the cancellation of debt may have to fill out a Form 1099-C. This form is specifically used to report canceled debts over a certain threshold. It is crucial to accurately report this information to ensure compliance with tax regulations.

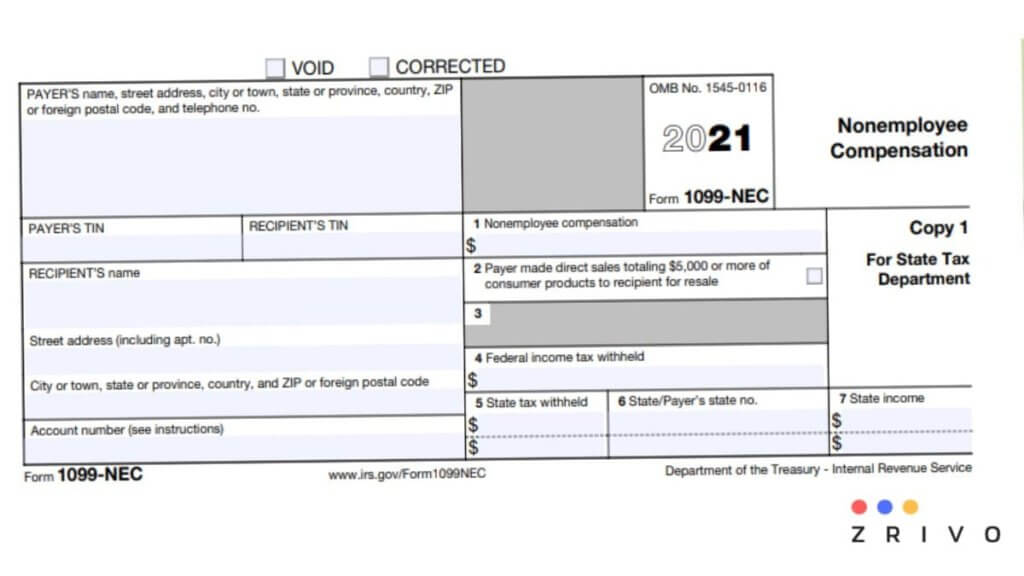

1099-NEC Instructions

1099-NEC Instructions

For individuals or businesses required to file the 1099-NEC form, it is important to review the instructions provided. These instructions detail the specific requirements and guidelines to fill out the 1099-NEC form accurately. By adhering to these instructions, you can ensure compliance with tax regulations and avoid any penalties.

For individuals or businesses required to file the 1099-NEC form, it is important to review the instructions provided. These instructions detail the specific requirements and guidelines to fill out the 1099-NEC form accurately. By adhering to these instructions, you can ensure compliance with tax regulations and avoid any penalties.

1099 Forms 2021 Printable

1099 Forms 2021 Printable

To simplify the process of filing taxes, printable versions of the 1099 forms for the year 2021 are available. These forms are essential for reporting various types of income, including self-employment income, interest income, and dividends. By utilizing printable versions of these forms, individuals and businesses can ensure accurate reporting and fulfill their tax obligations.

To simplify the process of filing taxes, printable versions of the 1099 forms for the year 2021 are available. These forms are essential for reporting various types of income, including self-employment income, interest income, and dividends. By utilizing printable versions of these forms, individuals and businesses can ensure accurate reporting and fulfill their tax obligations.