A W-2 form is an essential tax document that individuals receive from their employers at the end of each year. It is a summary of their earnings and the taxes withheld from their paychecks, providing the necessary information for filing income tax returns. For Asian people residing in the United States, understanding the W-2 form is crucial for properly fulfilling their tax obligations and availing themselves of any applicable tax benefits.

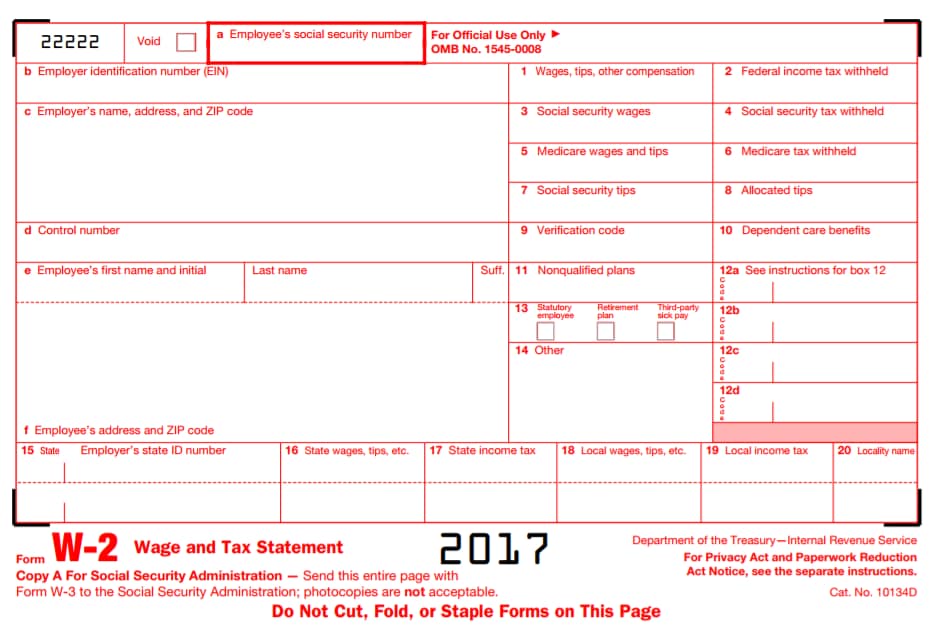

- Tax Form W-2 Worksheet - W2 Lesson Plan, Teaching Taxes

- What is a W-2 Form? - TurboTax Tax Tips & Videos

TurboTax, a popular tax preparation software, offers a detailed explanation of what a W-2 form is and how individuals should interpret the information it contains. The resource includes video tutorials that provide step-by-step guidance on how to read and understand the different sections of the form. Asian individuals can benefit from these tutorials to ensure they accurately report their income and deductions on their tax returns.

TurboTax, a popular tax preparation software, offers a detailed explanation of what a W-2 form is and how individuals should interpret the information it contains. The resource includes video tutorials that provide step-by-step guidance on how to read and understand the different sections of the form. Asian individuals can benefit from these tutorials to ensure they accurately report their income and deductions on their tax returns.

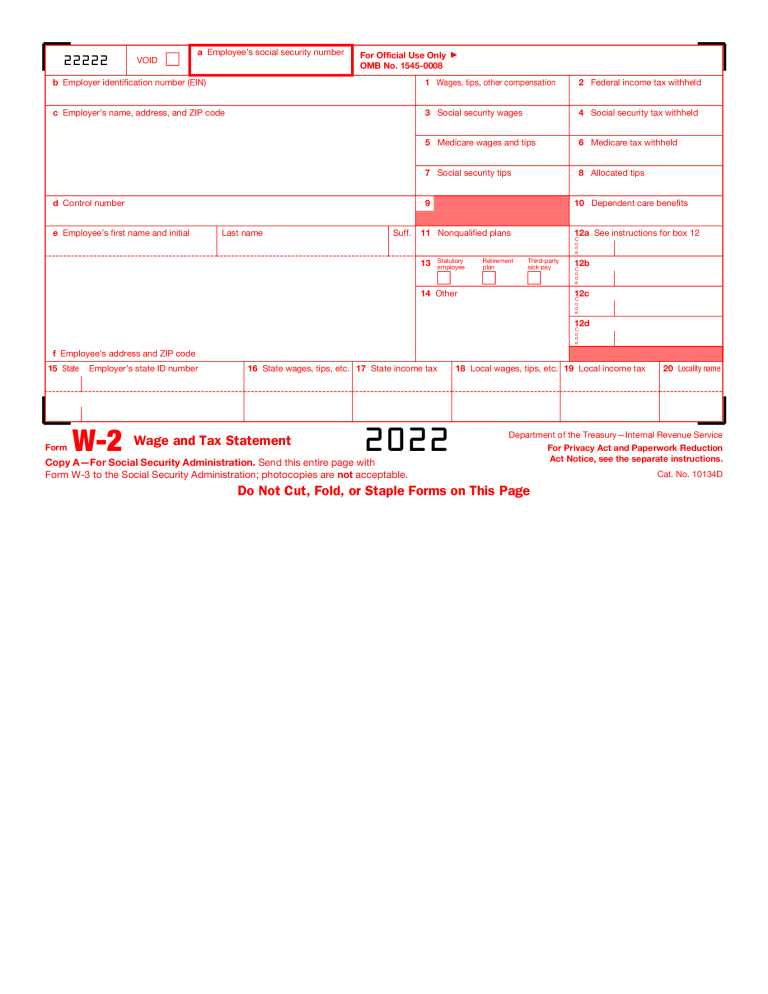

- 2022 W2 Free Fillable & Printable W 2 Form - Fillable Form 2023

To facilitate the tax filing process, Fillable Form 2023 offers a free and fillable version of the W-2 form for the year 2022. This resource allows Asian individuals to input their relevant information directly into the form online, eliminating the need for manual calculations or handwriting. It ensures accuracy and saves time while providing a hassle-free experience.

To facilitate the tax filing process, Fillable Form 2023 offers a free and fillable version of the W-2 form for the year 2022. This resource allows Asian individuals to input their relevant information directly into the form online, eliminating the need for manual calculations or handwriting. It ensures accuracy and saves time while providing a hassle-free experience.

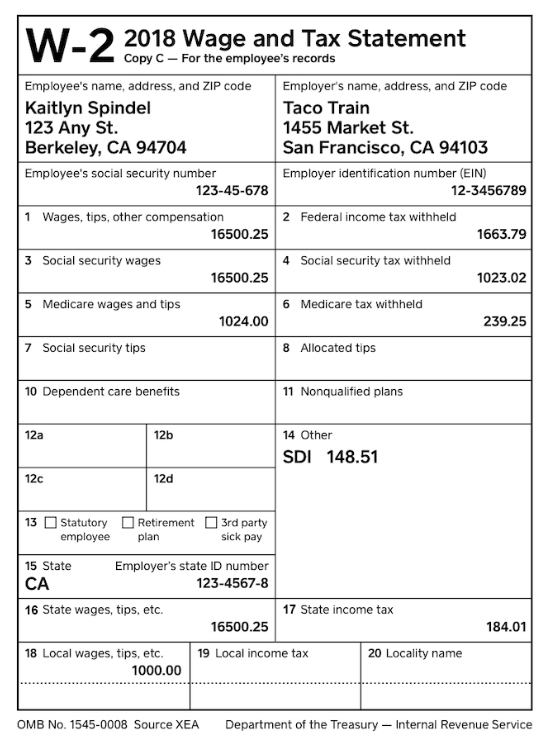

- Understanding 2018 W-2 Forms

Although the content might be slightly outdated, the purpose of understanding a W-2 form remains the same across different years. This resource, in the form of a visual guide, helps Asian individuals comprehend the key elements of a W-2 form from the year 2018. It highlights where to find crucial information, such as taxable wages, Medicare wages, Social Security wages, and any other relevant details that might be necessary for accurately filing taxes.

Although the content might be slightly outdated, the purpose of understanding a W-2 form remains the same across different years. This resource, in the form of a visual guide, helps Asian individuals comprehend the key elements of a W-2 form from the year 2018. It highlights where to find crucial information, such as taxable wages, Medicare wages, Social Security wages, and any other relevant details that might be necessary for accurately filing taxes.

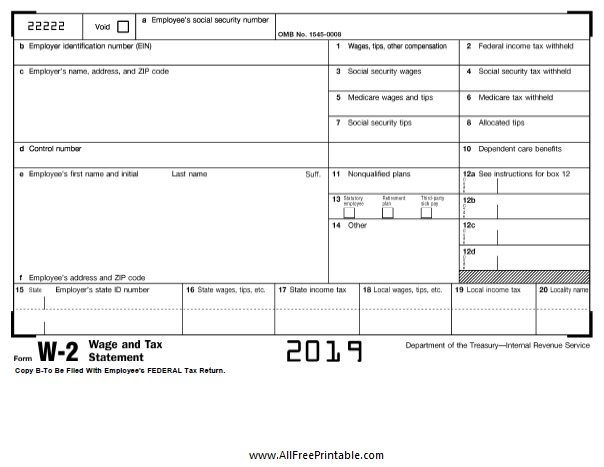

- Blank W-2 Forms – Free Printable

In certain situations, individuals may require blank W-2 forms. This resource provides free printable versions of the W-2 form, enabling Asian individuals to download and fill out the forms manually. Whether it’s for practice purposes, record-keeping, or any specific needs, having access to blank W-2 forms can be helpful for better understanding the layout and structure of the actual form.

In certain situations, individuals may require blank W-2 forms. This resource provides free printable versions of the W-2 form, enabling Asian individuals to download and fill out the forms manually. Whether it’s for practice purposes, record-keeping, or any specific needs, having access to blank W-2 forms can be helpful for better understanding the layout and structure of the actual form.

- Online Fillable W 4 Form - Printable Forms Free Online

While not directly related to the W-2 form, the W-4 form is significant in determining the amount of tax withheld from an individual’s paycheck. This resource offers an online fillable version of the W-4 form, allowing Asian individuals to easily complete the form electronically. Understanding the W-4 form is essential as it affects the accuracy of the W-2 form, and this resource provides a convenient way to handle the W-4 form digitally.

While not directly related to the W-2 form, the W-4 form is significant in determining the amount of tax withheld from an individual’s paycheck. This resource offers an online fillable version of the W-4 form, allowing Asian individuals to easily complete the form electronically. Understanding the W-4 form is essential as it affects the accuracy of the W-2 form, and this resource provides a convenient way to handle the W-4 form digitally.

- W2 Form Template - Create and Fill Online

Creating a W-2 form can be a complex task, especially for employers. However, this resource offers a W-2 form template that enables employers to easily create and fill out the forms online. It ensures accuracy and provides a professional format for presenting employees’ income and tax information. For Asian individuals who own businesses or employ others, this resource could be invaluable in ensuring proper tax reporting for their employees.

Creating a W-2 form can be a complex task, especially for employers. However, this resource offers a W-2 form template that enables employers to easily create and fill out the forms online. It ensures accuracy and provides a professional format for presenting employees’ income and tax information. For Asian individuals who own businesses or employ others, this resource could be invaluable in ensuring proper tax reporting for their employees.

- Form W-2: Understanding Your W-2 Form

:max_bytes(150000):strip_icc()/w2-9ca13523f4d74e958b821aab63af2e60.png) Investopedia, a renowned financial education resource, offers a detailed guide on understanding the W-2 form. It explains each box and code on the form, including various codes related to retirement plans, health insurance, and other benefits provided by employers. Asian individuals can refer to this resource to gain a comprehensive understanding of the different components and codes appearing on their W-2 form.

Investopedia, a renowned financial education resource, offers a detailed guide on understanding the W-2 form. It explains each box and code on the form, including various codes related to retirement plans, health insurance, and other benefits provided by employers. Asian individuals can refer to this resource to gain a comprehensive understanding of the different components and codes appearing on their W-2 form.

- 2015 W2 Fillable form 2015 W 2 Fillable form in 2020 | Fillable forms

Although this resource relates to the 2015 version of the W-2 form, it can still provide valuable insights into the overall structure and layout of the form. Fillable forms allow Asian individuals to practice filling out the form digitally and gain familiarity with its various sections. While the specific figures might not match the current year, the general format remains consistent across different versions of the W-2 form.

Although this resource relates to the 2015 version of the W-2 form, it can still provide valuable insights into the overall structure and layout of the form. Fillable forms allow Asian individuals to practice filling out the form digitally and gain familiarity with its various sections. While the specific figures might not match the current year, the general format remains consistent across different versions of the W-2 form.

- W2 Form 2021

Lastly, for those seeking information specific to the W-2 form for the year 2021, this resource provides insights into the latest version of the form. Asian individuals can refer to it to understand any recent updates or changes made to the form. Staying up to date with such information is vital to ensure accurate reporting and compliance with the tax regulations for the current year.

Lastly, for those seeking information specific to the W-2 form for the year 2021, this resource provides insights into the latest version of the form. Asian individuals can refer to it to understand any recent updates or changes made to the form. Staying up to date with such information is vital to ensure accurate reporting and compliance with the tax regulations for the current year.

In conclusion, understanding the W-2 form is essential for Asian individuals residing in the United States. By relying on the resources mentioned above, individuals can gain a comprehensive understanding of the various sections, codes, and figures presented on the form. Whether it’s through worksheets, video tutorials, fillable online forms, or printable templates, these resources cater to different learning preferences and make the process of comprehending and filing taxes smoother and more efficient.